You don’t have to look very far to see them. You don’t need to open your eyes to feel their looming presence as the dread they stir inside you grows. The mountains that marketers face seem to be more numerous every day. Some pop up unexpectedly, while others have been slowly coming into focus as your distance to them narrows. From economic uncertainty to political instability and financial upheaval, hear about a range of challenges that all need to be scaled somewhat simultaneously … and ask yourself, are my enterprise and team ready to climb them, and am I?

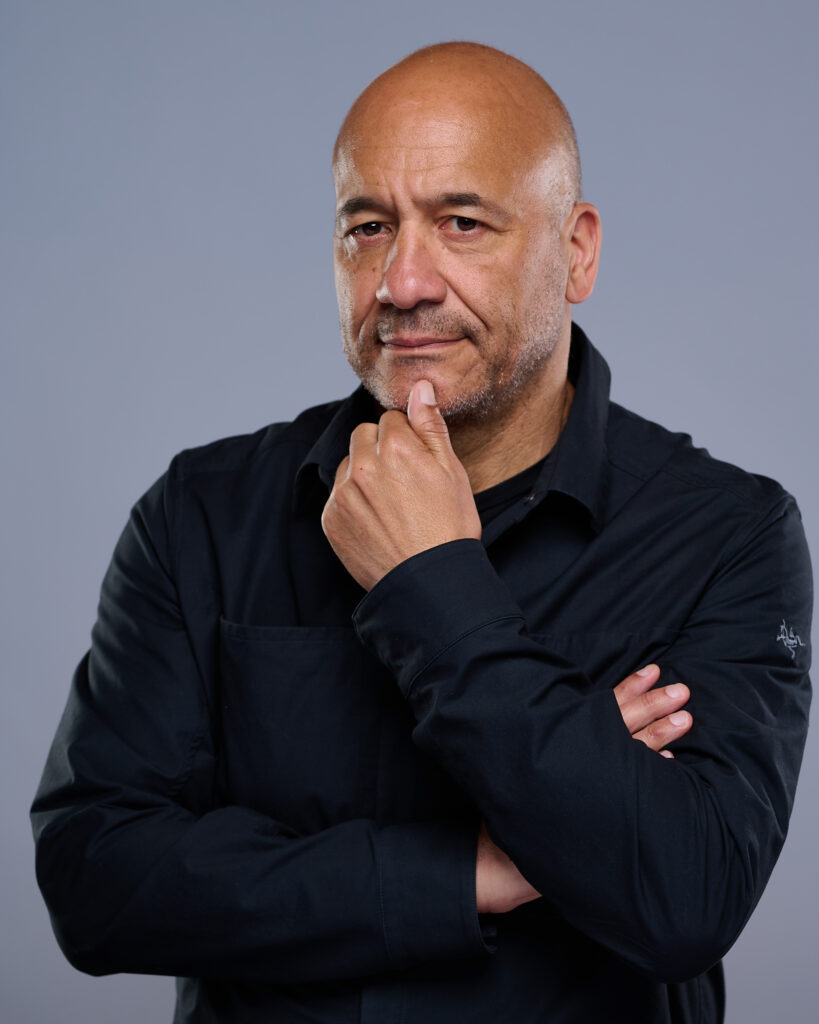

I didn’t realize when I set this as the theme for SponsorshipX Whistler 2023 and the opening keynote summary that I was creating a mountain for myself. It was not whether we could stage an event about overcoming challenges. No, selfishly, it was whether I could make a keynote worthy of the theme. This was the first time I was nervous about delivering a presentation in a long time.

Seriously, this was Pepto Bismol nausea. A few days before SponsorshipX kicked off, my stomach was contorted in pain, and the symptoms were so disgusting that they were not fit for this blog. At first, I was worried it was something I had eaten, but I quickly realized I was anxious about this new presentation. It was less to do with creating something new and much more to do with the fact that I had been relying on one keynote – A Conversation About Belonging- over the past two years, which I had delivered dozens of times. I had that keynote down cold, and giving it was second nature.

Now I had to talk about something to do with Scaling Mountains.

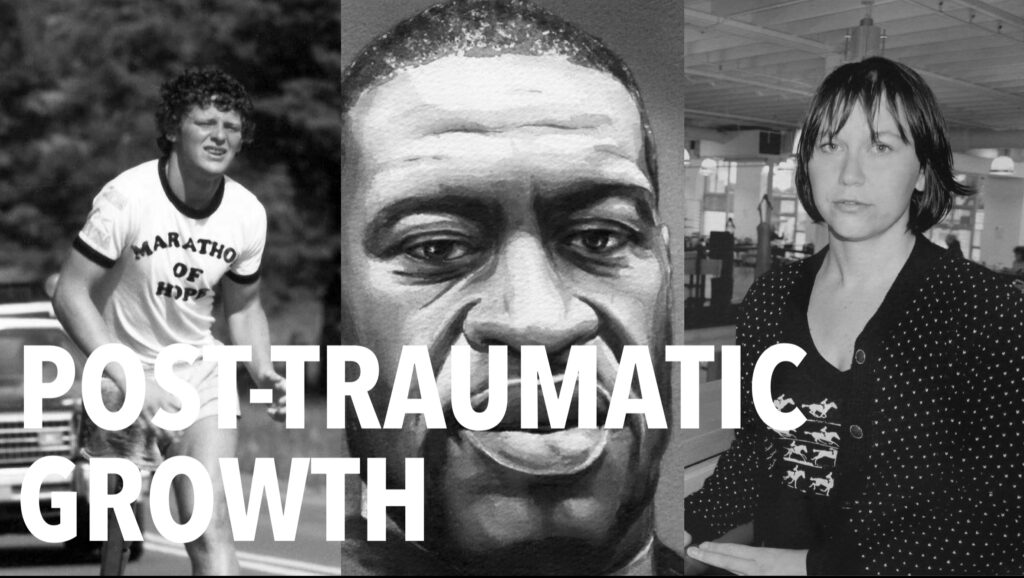

So I did, and the presentation I shared with our guests went like this. When faced with adversity, we can learn and develop. There is a significant conversation about this phenomenon right now. It is called Post-Traumatic Growth. To paraphrase the experts, this is a condition where some trauma has shattered your psychological beliefs, and the outcome is a changed self. This self often immerses themselves in a new life purpose. We educate ourselves for change, commit to service, find a higher calling, and disclose secrets to new friends.

Think of Terry Fox in finding compassion in the cancer ward when surrounded by child patients who, despite being very sick, were full of future optimism. Think about how the world responded to George Floyd’s murder or the conviction of Jamie Black to tackle the issue of missing and murdered Indigenous and Metis women.

After reading and thinking substantially about Post Traumatic Growth, it felt like a natural foundation for a discussion. My presentation became less keynote and more of a call for all of us to brainstorm how to use PTG to Scale Mountains. I offered our delegates five thought starters, which I will share now.

ADVOCATE: find a cause, a purpose, or a mission that is deeply important to you or your enterprise.

LIBERATE: We may commemorate Emancipation Day in Canada this week, but ask yourself: are Black people free in this world? Are women? Are queer folk? Companies can help liberate people by fighting for their rights.

COLLABORATE: if the pandemic, invasion of Ukraine, and the current global mental health crisis have shown us, we are all better off when we collaborate. Partnering today could save our business or our lives tomorrow.

INNOVATE: whether facing tight budgets or the uncertainty of AI, we need to innovate. But innovation is not about Technology or Process; it’s about People.

CELEBRATE: I went a little Tony Robbins on the group and asked everyone when was the last time they told themselves they loved themselves. I will ask you the same question. In an era where HR departments implore us to love our teams, you must prioritize self-love. A daily personal pep talk can help you be a better leader, and your teams will benefit from your self-care.

As a person who loves public speaking, it was odd for me to be rattled about presenting to my peers. Ironically, I needed the taste of my medicine and the Pepto to overcome the challenges.

There is a lesson for me – “Practice what you preach.” I may start using that.

I wonder if it will become popular.